Toeslagen Tragedie: The exhibition texts in English

The Childcare Benefit Scandal

Imagine it happening to you: forced into living in extreme poverty for years, crushed by mounting debts and financial stress. Losing your job, your home, your child, yourself – everything. All because you were wrongly labelled a defrauder and treated as one. Or simply because you made some small mistakes.

From 2005 to 2019, lives were ruined and tens of thousands of families were destroyed by a government system. By sharing personal traumas and providing insight into the mistakes and many wrong decisions made by the cabinet, parliament, government agencies and the courts, there is only one possible conclusion: this must never be forgotten and must never happen again.

Initial misguided decisions and mistakes

In 2003, the Tax and Customs Administration was tasked with implementing a new benefits system. This required an IT system to be developed within two years. This system would enable the newly established Tax and Customs Administration Benefits Department, with 600 employees, to pay out around 6 million benefits (for healthcare, housing and childcare).

The Childcare Act administered by the Ministry of Social Affairs sets out strict conditions for benefit entitlement, including payment of a personal contribution. The amount of the childcare benefit depends on many factors, including income, and the number of hours and costs of childcare. The Income-dependent Benefits Implementation Act of 2005 had a limited hardship clause that did not allow sufficient flexibility ‘in the event of unforeseen and unreasonably disadvantageous consequences.

The implementation went wrong immediately: the IT system proved inadequate. When, in 2006, almost a million people had to wait months for their benefits, political pressure led to priority being given to the swift payment of benefits (advances), without any prior checks being performed.

The backlogs accumulated throughout the implementation chain, and retrospective checks were sometimes only carried out years later. It was easy for people to make a mistake when applying, and incorrect data was automatically carried over from year to year. When the entitlements were finalised in 2008, it turned out that 50% of all applicants had been receiving overpayments. This led to the first recoveries of large amounts, particularly in the case of childcare benefits.

The Tax and Customs Administration had already adopted a hard-line position in the implementation, and this interpretation of the law would result in the recovery of benefits in full if the entitlement conditions were not met (either partially or fully). This was later referred to as the ‘all-or-nothing’ position)

Zo hadden we het niet bedoeld

De tragedie achter de toeslagenaffaire

(That’s Not What We Meant

The tragedy behind the benefit scandal)

Jesse Frederik, 2021

In this book, investigative journalist Jesse Frederik reconstructs ‘how the benefit scandal came about and was able to bring down the government’. Herman Tjeenk Willink: ‘This book shows what happens when preconceived ideas and personal feelings triumph over facts and values, when collective memory has faded and feasibility doesn’t count in politics. That’s when citizens who depend on the government suffer.’

Kafka in de rechtsstaat

De gevolgen van een leesfout: de toeslagenaffaire ontleed

(Kafkaesque Rule Of Law

The consequences of a misreading: the benefit scandal laid bare)

Ellen Pasman, 2021

‘Anyone thought to have committed a crime has already been found guilty,’ according to Franz Kafka’s 1925 novel The Trial. Lawyer Ellen Pasman observes that parents caught up in the childcare benefit scandal experienced that same feeling a century later. ‘What went wrong with the childcare benefit was no accident, but a symptom of years of neglecting the rule of law.’

Leuker kunnen we het niet maken

Over het toeslagenschandaal en de vrouw die het aan het licht bracht

(We Couldn’t Have Made It Any More Fun

About the benefit scandal and the woman who brought it to light)

Renske Leijten, 2024

In her book, former MP Renske Leijten reconstructs how lawyer Eva González Pérez used crucial internal documents in her efforts to expose one of the biggest political scandals in recent Dutch history. Jan Kleinnijenhuis: ‘It all started with Eva. She was a nightmare for the Tax and Customs Administration – and that is a tremendous compliment.’

Ongekend onrecht (Unprecedented Injustice) Report,

Parliamentary Committee of Inquiry into the Childcare Benefit, 2020

Key findings: ‘Fundamental principles of the rule of law were violated in the implementation of the childcare benefit. This criticism applies not only to the implementation – specifically the Tax and Customs Administration Benefits Department – but also to the legislature and the courts.’

Many parents suffered unprecedented injustice. ‘Unprecedented because it took a long time for the extent and seriousness of the situation to be recognised by political and civil service leaders. Unprecedented because the information provided by the Tax and Customs Administration was very limited. Unprecedented because the way in which parents were treated was disproportionate to what they were often unjustly accused of by the Tax and Customs Administration. … Due to the complete inability to do justice to individuals, parents did not stand a chance for years.’

Lessen uit de kinderopvangtoeslagzaken

(Lessons Learned from Childcare Benefit Cases), Reflection Report,

Administrative Jurisdiction Division of the Council of State, 2021

At the beginning of 2021, the Council of State launched a reflection programme with the aim of learning from the past, drawing lessons from it and making recommendations for the future. ‘The most important conclusion of the reflection is that the Administrative Jurisdiction Division adhered to the ‘all-or-nothing’ approach for too long. It could and should have changed this approach earlier. By failing to do so, the Administrative Jurisdiction Division did not provide parents who consequently found themselves in difficulty with the legal protection they were entitled to receive. This must not happen again. It therefore offers its apologies in this regard.’

Blind voor mens en recht (Blind to People and Justice) Report,

Parliamentary Committee of Inquiry into Fraud Policy and Services, 2024

The main conclusion of this parliamentary inquiry, in which victims were also heard, is as follows:

‘The committee concludes that, in a hardened political and social climate, the three branches of government were blind to people and justice. This destroyed people’s lives. The committee finds it distressing that the social security and benefits system, which is intended to support people, contributed to ruining those very same people. The cabinet and parliament failed, the implementation was unlawful and the courts failed to protect people. As a result, people’s fundamental rights were violated and the rule of law was set aside. The committee’s investigation shows that there are various underlying patterns here, which have not yet been changed to this day.’

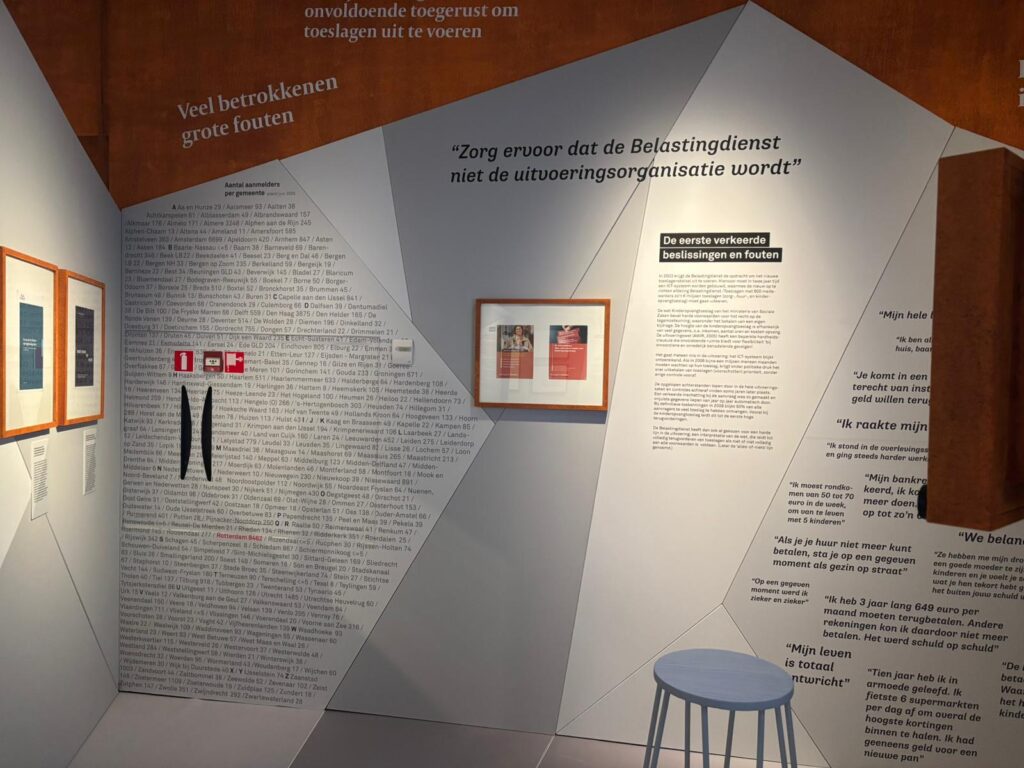

Number of victims per municipality, June 2025

Weggecijferd Teruggevochten (Erased Fought Back)

Bert Teunissen, 2021–2022

The Socialist Party commissioned Photographer Bert Teunissen to take portraits of 100 families affected by the childcare benefit scandal. He published the portraits in the book Weggecijferd Teruggevochten. In doing so, he gave people who had been reduced to a file number a face again. ‘People like you and me.’ From March 2022, the portraits have been exhibited in outdoor and indoor spaces across the Netherlands.

[Quotes]

Why me, why us? Why were we unfairly accused?

There are people who don’t believe you. But if the taxman says it, you must have done something wrong, right?

I never want to be in such a deep hole again.

I was ashamed of the situation I was in. Most people around me didn’t know about it, and they still don’t.

The annual attachments went on forever.

My whole life was ruined.

Every time they asked what we were going to eat, I said: we’ll see.

I lost it all: house, job, family – everything.

A repayment of 2,500 euros a month – I didn’t even earn that amount. I thought: How? I’ll never forget it: pay, pay, repay, repay – but with what?

You end up on a merry-go-round of agencies that want to recover money.

I lost my money, my job and my child.

I was vomiting all day because of money stress.

I was in survival mode and kept working harder and harder.

I never want to see an empty fridge again.

I had to live off 50–70 euros a week, with five children.

My bank account was blocked; I couldn’t pay for anything. My debts kept growing until they reached around 68,000 euros.

The Tax and Customs Administration has already been garnishing my wages for three years and soon my house will be forcibly sold.

We ended up in debt restructuring.

If you can’t pay your rent, sooner or later you end up on the street with your family.

They robbed me of my dream of being a good mother to my children, and you feel guilty about what you failed to do for them, even though it wasn’t your fault.

You can no longer pay your rent. You can hardly pay for groceries. You have other bills to pay. In three months, we had lost everything.

At a certain point, I got sicker and sicker.

For three years, I had to repay 649 euros a month. This meant I couldn’t pay other bills. The debts piled up.

Mummy, you were never around.

My life was completely shattered.

For ten years I lived in poverty. I’d cycle to six supermarkets every day to get the best discounts. I didn’t even have enough money for a new pan.

The daycare manager said: The Tax and Customs Administration is no longer paying for your childcare and after-school care. It’s probably a mistake but until you’ve sorted it out, we’re not allowed to provide childcare for your children.

When our children were taken away in 2016, our faith and everything we had worked for was also lost.

Initial fraud investigations and victims

The system quickly proved to be vulnerable to fraud, especially in the case of childminders. Since 2005, childcare provided at home by grandparents, for example, had been an official form of childcare for which subsidies could be claimed, provided it was arranged in a contract through a childminder agency.

After abuses were identified, the first investigations began in 2008. Some agencies were found to be working with forged childcare agreements or were committing fraud by claiming more hours of care or registering more children. A few even advertised ‘free childcare’, even though a personal contribution was one of the criteria for entitlement to the childcare benefit.

The consequences for parents were severe: the benefit was stopped across the board, and all parents were examined. They had to provide supporting documents, and in the event of any discrepancies, the benefit was reclaimed in full.

In 2010, publicity led to questions in Parliament: could the overpayments be recovered from the defrauders instead of the parents? The Minister of Social Affairs replied that the responsibility for the accuracy of the application lies with the applicant. Parents can take the matter to court…And that is what they did, all the way up to the Council of State.

In the meantime, numerous measures were taken to make the system less prone to fraud, and efforts were made to tighten up the fraud policy. At the same time, doubts were being raised at the Tax and Customs Administration Benefits Department: wasn’t it possible to change the ‘all-or-nothing’ position to more limited recovery? The signals sent out did not reach the political top of the Finance and Social Affairs ministries, or ultimately, nothing was done with them.

And then, in 2012, the Council of State decided in favour of the hard line of the Tax and Customs Administration and upheld that ruling in virtually every case up to 2020. The ‘all-or-nothing’ working method continued.

How the government’s hunt for fraud turned into a tragedy

[Quote]

Even the sound of the letterbox terrified me!

Gebroken identiteit (Fractured Identity)

Beata Bruijn, 2024

This artwork, created from the heart, arose from misery yet depicts strength. Beata was recognised as a victim of the benefit scandal in 2022. She created this artwork from recycled materials to express and process her emotions. Beata has been active as an educational worker for over 35 years and founded the Rechance foundation three years ago. In her studio, she works as a creative coach, helping fellow victims, among others, to process their experiences creatively. She is also affiliated with Onzichtbaar Den Haag (Invisible The Hague) as a lived experience expert.

Rechance foundation collection – Beata Bruijn

Toeslagenaffaire 2 (Benefit Scandal 2)

BAN, 2023

The artwork Toeslagenaffaire 2 by Rotterdam artist BAN is part of his series Plakkerijen – a series of artworks in which he uses glue and paper as a form of paint.

BAN created this work from blue envelopes that he himself received from the Tax and Customs Administration after spending twelve years in Ireland. He depicts the end result as a stormy sea with high waves, in which he has drawn the faces of drowning people. He created the work during the period when the benefit scandal was in the news. Toeslagenaffaire 1 was sold to someone involved in the UK’s Post Office Horizon scandal.

Uithuisplaatsingen (Out-of-home Placements)

Eliane Gerrits, 2022

Eliane Gerrits’ watercolour cartoon poignantly depicts the start of an out-of-home placement. Eliane made the drawing in May 2022 in response to the controversy surrounding the police escorting children placed in out-of-home care by Youth Care. The first figures linking the removal of children to the benefit scandal were published by Statistics Netherlands in October 2021. In 2025, the report titled Legacy of Injustice by the Committee on Benefits and Out-of-Home Placements concluded that the benefit scandal was a major cause of children being removed from the homes of affected families. The cartoon was published in the magazine EW.

Hearing of Ms Gonçalves Tavares, 2023

Ms Gonçalves Tavares, a single working mother of three, received a letter from the Tax and Customs Administration in 2009 stating that she had to repay 125,000 euros. It later transpired that her children had been in the care of a fraudulent childcare organisation. She herself was wrongly labelled a defrauder. She was the first victim to be heard by the parliamentary committee of inquiry into fraud policy and services. Her moving testimony told the story of the scandal as a whole and as a personal trauma.

Fraud hunt goes off the rails

The media storm surrounding the Bulgarian Fraud (0.05% of the total amount of benefits paid out) led to a wave of public outrage and political uproar. Enough was enough. The problem was not tackled at its root – it concerned address fraud – but political pressure demanded an even tougher approach to benefit fraud.

The Tax and Customs Administration Benefits Department had to enforce measures more strictly and work with a new digital risk assessment system to identify people with a ‘high-risk profile’ and determine, among other things, who should be subject to additional checks. From that point on, a fraud detection system (that generated and updated a list of signs of fraud) also went into use.

New fraud teams were set up, including the Approach Facilitators Combiteam (CAF). More than 200 additional inspectors had to earn their keep by detecting fraud, initially at childminding agencies and childcare institutions. But parents were also viewed as potential or actual defrauders.

If the CAF team identified someone as ‘high risk’, ‘the process’ would begin: the immediate termination of benefits with no justification provided, requests for supporting documents with no clarity provided about such documents, the indefinite termination of benefits if the slightest irregularities were found (zero tolerance). There was no mention of objection options in letters, processing times for requests for reviews and objections were long, new applications were blocked and requests for payment arrangements were rejected due to the unjustified qualification ‘intent/gross negligence’.

For many years, in most cases where legal action was undertaken, the highest court ruled in favour of the Tax and Customs Administration. The debt collection process continued: full benefits were recovered over several years, through wage garnishments, attachments and forced settlement.

[Quotes]

It started with blue tax envelopes through the letterbox.

The benefit was stopped because they first needed to find out if we were entitled to it, so while they investigated…

I had to repay 15,000 euros. The reason wasn’t clear, I sent all the information again, but it was rejected because they said I wasn’t entitled.

The benefits were stopped. In hindsight, we know that this was the moment my mother was flagged as a defrauder.

Something always seemed off, and new questions kept cropping up. I had to pay back everything. At first it was for one year, but then it became three.

According to the tax authorities, it was entirely my own gross negligence. No tolerance, none whatsoever.

Despite placement certificates, invoices and annual overviews from the childcare centre, the years 2009, 2010, 2011 and 2012 were reclaimed due to insufficient evidence that I had actually used childcare.

The tax authorities lost all the evidence I gave them – three times over.

I received a letter stating that I had not provided any evidence and therefore had to repay the childcare benefit in full.

We had to repay 22,000 euros: we had been duped because the owner committed fraud: she hadn’t fully paid her contribution.

I printed out 89 pages – twice. All my childminding services were paid for through the bank. Everything could be verified. My children have a Turkish father, so they have Turkish names.

I submitted several objections but never received a substantive response; all they said was that they were too late in responding.

My objection was rejected, time and again.

I was put on a blacklist.

Would I simply repay 10,000 euros?

That agency, as it turned out later, was committing fraud. Could we do anything about it? No, yet the tax authorities labelled us all criminals, as I experienced first-hand.

In a letter I received, the conclusion was that the supporting documents provided were not correct and therefore the childcare benefit had been stopped.

Toeslagenaffaire (Benefit Scandal) political cartoons

Bas van der Schot, 2020 and 2022

The cartoon of a smiling and crying Prime Minister Rutte dated 22 January 2020 was drawn after a meeting between the Prime Minister and affected parents. The cartoon depicting ‘De Staat’ (The State) as a baseball player about to hit a child’s head refers to the removal of children from their home. Youth care is depicted as the catcher, while the judge in his robe is the umpire, giving an approving thumbs-up sign. Bas van der Schot’s cartoons were published in the Volkskrant newspaper.

Het Binnenhofje (The Little Parliament)

Eliane Gerrits, 2021

At Het Binnenhofje daycare centre, Prime Minister Mark Rutte and Minister for Finance Wopke Hoekstra offer the resignation of the Rutte III Cabinet to the king. On the left is Tamara van Ark, who was State Secretary for Social Affairs in 2019. On the right are MPs Pieter Omtzigt and Renske Leijten, who helped expose the benefit scandal. Outside, former Minister for Social Affairs and Employment Lodewijk Asscher (2012–2017) is passing by. Asscher had withdrawn as leader of the PvdA (Labour party) a few days earlier, following the publication of the report Ongekend onrecht (Unprecedented Injustice). On the far right is Eric Wiebes, former State Secretary for Finance (2014–2017). He resigned immediately after the fall of the Cabinet on 15 January 2021. This watercolour cartoon was published in the magazine EW.

Letter of apology on behalf of the Cabinet

From 2021

Parents affected by the benefit scandal received a letter from the State Secretary for Benefits and Redress containing an apology made on behalf of the Cabinet ‘for the way in which we have treated you’. The letter was accompanied by an official statement, also signed by the Prime Minister, stating that the parent(s) had not committed childcare benefit fraud. The letters and statements were sent to parents who, as victims, had received compensation or were going to receive it. In September 2021, the first group of affected parents received the letter and statement in a white envelope.

Letter of apology for registration in the fraud detection system

From 2022

From September 2022, people received a letter of apology from the Tax and Customs Administration for the recording of their personal data in a fraud detection system (FSV). Initially, the letter was sent to people for whom research had shown that the registration had no consequences. The FSV was discontinued on 27 February 2020. In 2022, the Data Protection Authority imposed a fine of 3.7 million euros on the Tax and Customs Administration for years of illegal processing personal data in the FSV. People can request compensation if the registration had demonstrable adverse consequences.

[Quote(s):]

The financial misery people are falling into; I can’t just abandon them.

I burst into tears, because it suddenly dawned on me

that the enormous suffering of the past ten years should never have happened.

The scandal is exposed

Since 2014, lawyer Eva González Pérez had been fighting the Tax and Customs Administration Benefits Department. She had been trying to get justice for affected parents in one case: CAF 11, her husband’s childminding agency that had been wrongly accused of fraud.

She had the support of the National Ombudsman, who in August 2017 issued a report strongly criticising the disproportionately harsh treatment of the families in this case. Support also came from within the Tax and Customs Administration, from Benefits Appeals Officer Joop Hack, and from the politicians Pieter Omtzigt, Farid Azarkan and Renske Leijten.

The first signs that something was seriously wrong had already been identified internally at the Benefits Department in March 2017. In an analysis of the CAF 11 case, Legal Adviser Sandra Palmen wrote that the group-based termination of benefits was unlawful and that parents were being denied protection under the law. She recommended that the parents should be compensated as a group. However, nothing was done with this ‘Palmen memo’.

Journalists Jan Kleinnijenhuis (Trouw newspaper) and Pieter Klein (RTL Nieuws, a TV news programme) had been publishing a series of revelations about the practices of the Tax and Customs Administration Benefits Departments since the end of 2018. Parliamentary questions and debates followed one after another. It took a long time for people to become aware of the problem and for information to emerge that CAF 11 was not an isolated case and that there were more victims.

When, in October 2019, after ten years the Council of State abandoned its ‘hard line’ in rulings on childcare benefits, the ‘all-or-nothing’ approach finally came to an end.

Revelations in the media continued, including about discrimination and the unjustified imposition of the qualification ‘intent/gross negligence’. On 15 January 2021, the report Unprecedented Injustice led to the fall of the Cabinet.

[Quote:]

Have you already received your money? As if that would be the end of the story…

Een einde aan het Toeslagenschandaal. Nu!

(Stop the benefit scandal. Now!)

Reproductions of protest signs, 2021

On Thursday, 11 November 2021, exactly two years after the first march with affected mothers, a second march was organised. In 2019, parents walked with Renske Leijten in a historic march from Coolsingel to the Tax Office in Rotterdam to demand justice, recognition and redress for the victims. The problems were still unresolved in 2021. That is why the mothers took the initiative again. Together with their families, they walked the same route once more to demand an end to the benefit scandal and the next step be taken with a list of demands for full redress. Among the speakers in 2021 were the politicians Renske Leijten and Farid Azarkan along with affected mothers, including Maria Sanchez.

Redress?

As the scandal unfolded, there were loud calls for swift and ‘generous’ compensation. In 2020, the first steps were taken, and the Benefits Redress Organisation (UHT) was established.

Following the final report of the Donner Committee, the first compensation schemes were set out in the AWIR Hardship Adjustment Act: for parents who were treated in the same ‘biased’ manner as in the CAF 11 case, parents who were affected by the harshness of the ‘all-or-nothing’ approach, and parents who did not receive a payment plan (due to the qualification ‘intent/gross negligence’). At the end of 2020, the Cabinet decided to pay, as soon as possible, 30,000 euros to all parents who had been affected between 2005 and 2019 (Catshuis scheme).

It is evident that when the redress procedure began, it was far from clear how widespread the damage was, how many victims there actually were and what the actual damage was.

Six years after the initial commitment to find a ‘suitable solution’ for the parents in the so-called CAF 11 case, 43,175 parents have been recognised as victims.

They are often asked by those around them, ‘Have you received your money yet?’. Even though many may now be able to answer ‘yes’ to that question, more is needed for their recovery. People lost a part of their lives; they were not believed.

Emotional recovery through recognition and support is just as important, and so is regaining mental health, employment and housing and, last but not least: we need systemic change! Without these things, there can be no real redress. Everyone, all the people inside and outside the system, must listen, observe, speak and act to tackle the fundamental problems. Only then can we ensure that this will never happen again.

Leave a message